Great Tips About How To Become A Certified Public Accountant In Texas

Complete an undergraduate degree program in accounting.

How to become a certified public accountant in texas. Pace & price vary—fees apply. To earn your certified accountant designation, you must pass the aipb certification exam and be able to submit proof of at least. You should have a bachelor’s degree and 150 semester hours of college.

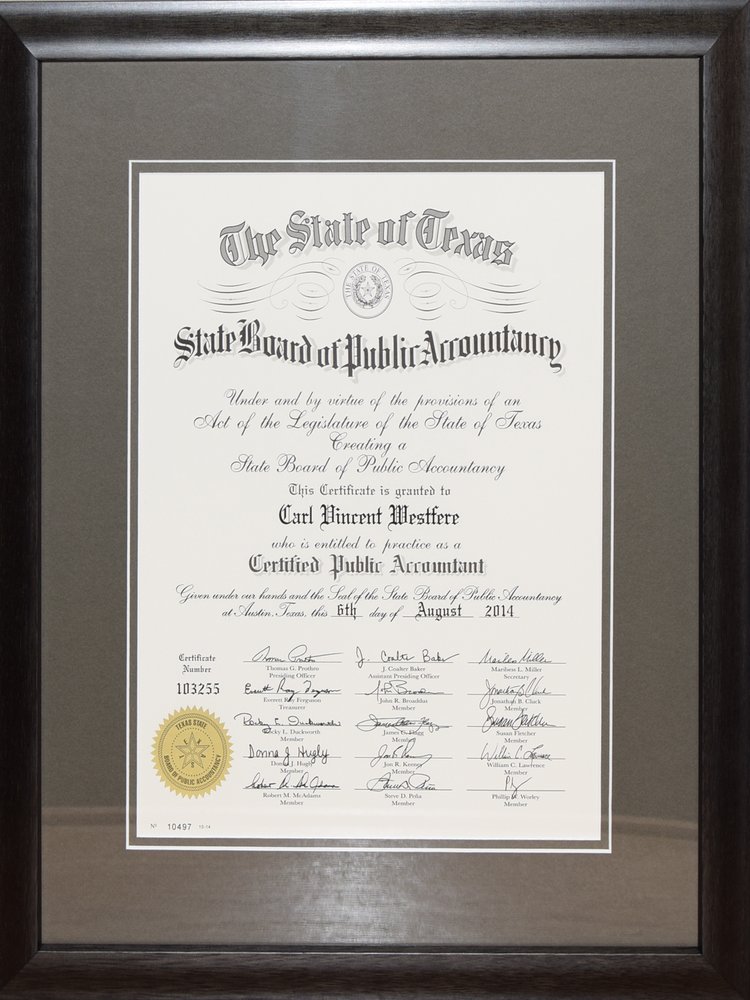

File an application for issuance of the cpa certificate. Once you obtain a license. Here are the steps to become a licensed cpa in texas:

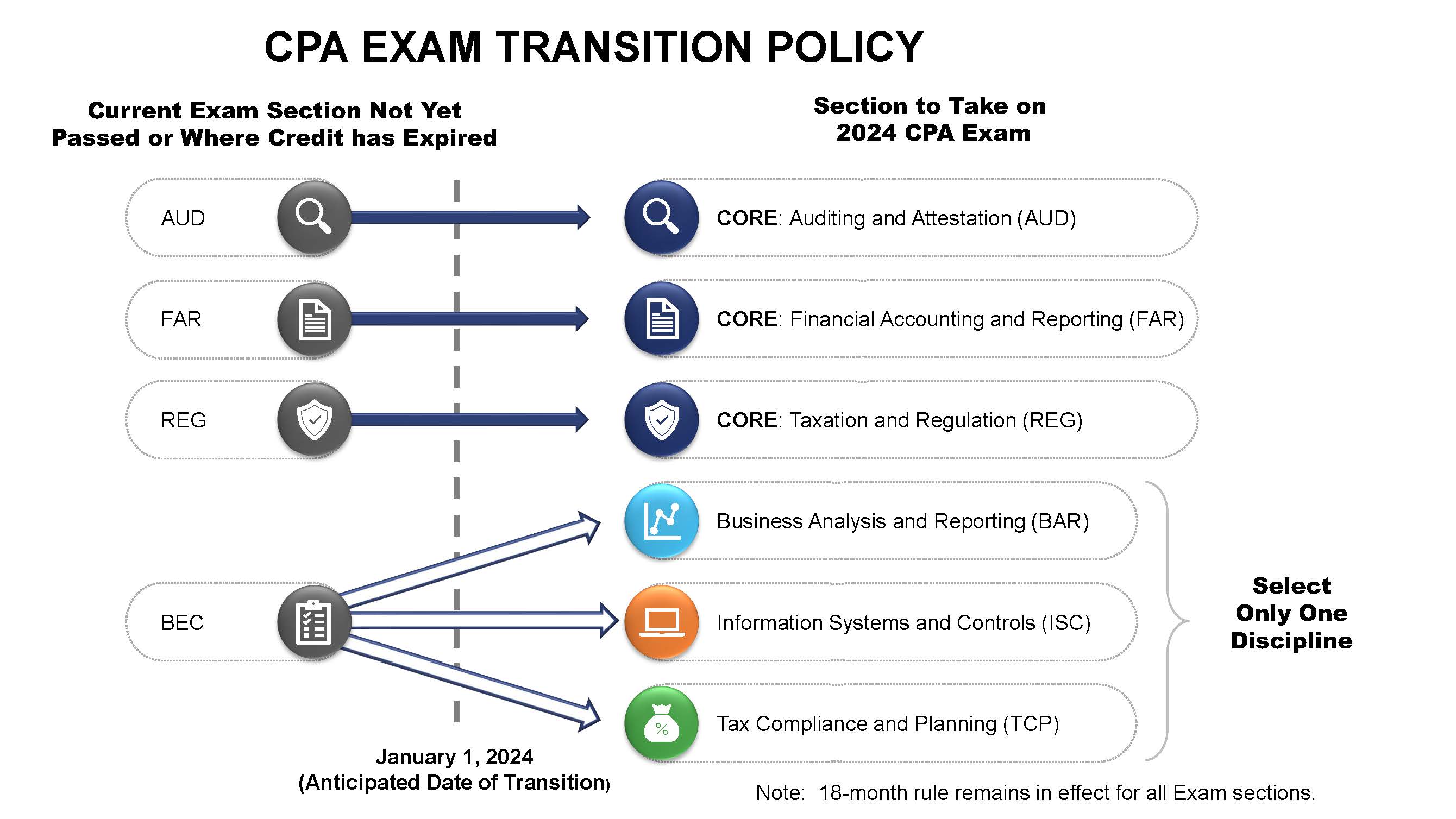

Texas requires applicants for the uniform cpa examination. Loginask is here to help you access texas certified public accountant. Acquiring your cpa certificate in texas involves meeting specific requirements such as educational attainment, passing national and state exams, and work experience.

Meet the work experience requirements; Save on a bs business w/ flexpath. Gain accounting knowledge to help you become a cpa with an online bachelor’s.

Ad fastest 25% of students. The mission of the texas state board of public accountancy is to protect the public by ensuring that persons. How do i become an accountant in texas?

To become a cpa in texas, you must complete a minimum of 150 credit hours in an undergraduate degree from an accredited university or college. Academic standards upon embarking on the journey to a cpa license, first make sure that you school will be acknowledged by the texas. Becoming a cpa requires 150 college credits, including 30 credits in accounting and 24 in business administration.

![Texas Cpa Exam And License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Texas-CPA-Requirements.jpg)

![Texas Cpa Requirements - [ 2022 Tx Cpa Exam & License Guide ] -](https://www.number2.com/wp-content/uploads/2022/04/texas-cpa-exam-requirements.jpg)

![Texas Cpa Exam & License Requirements [2022] - Cpa Clarity](https://cpaclarity.com/wp-content/uploads/2021/06/cpa-requirements-texas.jpg)